Muthoottu Mini Financiers Limited operates as a non-deposit-taking NBFC-ML specializing in gold loans, providing loans secured by household gold jewelry. The company serves clients across Kerala, Tamil Nadu, Karnataka, Andhra Pradesh, Telangana, Haryana, Maharashtra, Gujarat, Delhi, Uttar Pradesh, Goa, and the Union Territory of Puducherry.

In addition to gold loans, the company offers microfinance services, providing unsecured loans to groups of women (minimum of 5) who share joint liability and seek funding for their business needs.

As of September 30, 2024, Muthoottu Mini Financiers operated 920 branches across these states and territories, employing a workforce of 4,672.

Muthoottu Mini Financiers NCD IPO October 2024 Detail

| Issue Open | October 30, 2024 – November 13, 2024 |

| Security Name | Muthoottu Mini Financiers Limited |

| Security Type | Secured, Redeemable, Non-Convertible Debentures (Secured NCDs) |

| Issue Size (Base) | Rs 100.00 Crores |

| Issue Size (Oversubscription) | Rs 50.00 Crores |

| Overall Issue Size | Rs 150.00 Crores |

| Issue Price | Rs 1000 per NCD |

| Face Value | Rs 1000 each NCD |

| Minimum Lot size | 10 NCD |

| Market Lot | 1 NCD |

| Listing At | BSE |

| Credit Rating | CARE A-Stable by CARE Ratings Limited. |

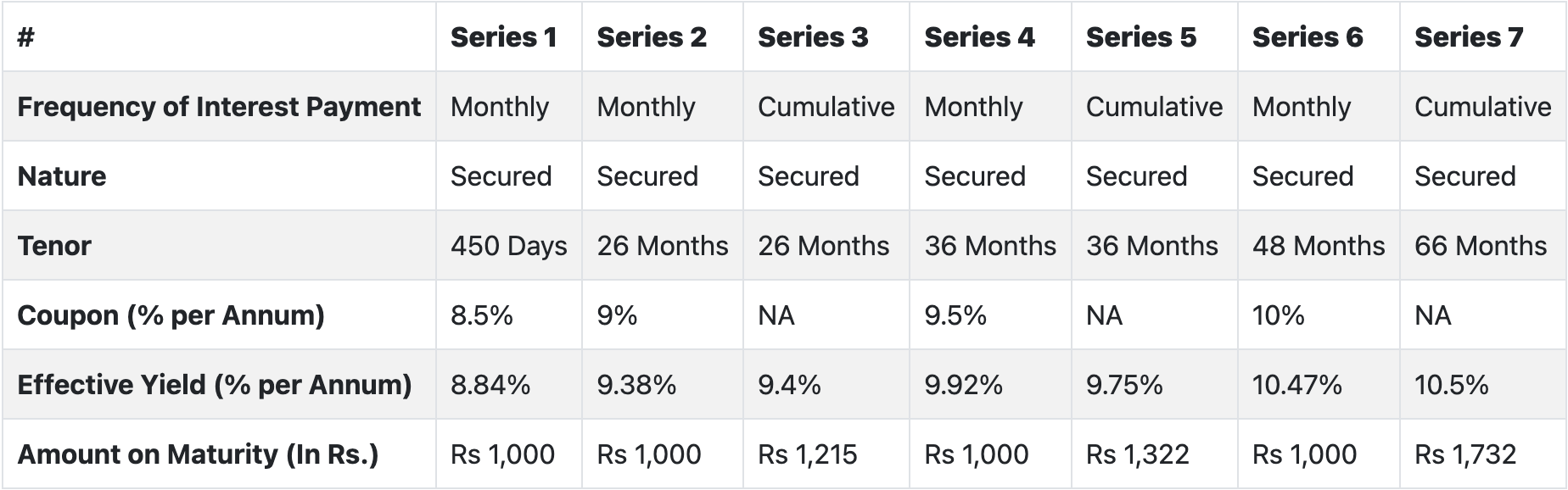

| Tenor | 450 Days, 26, 36, 48, and 66 Months |

| Series | Series I to VII |

| Payment Frequency | Monthly and Cumulative |

| Basis of Allotment | First Come First Serve Basis |

| Debenture Trustee/s | Mitcon Credentia Trusteeship Services Limited |

NCD Allocation Ratio

| Category | NCD’s Allocated |

|---|---|

| Institutional | 10% |

| Non-Institutional | 40% |

| Retail | 50% |

Muthoottu Mini Financiers Limited NCD Coupon Rates

NCD Rating

The NCDs proposed to be issued under the Issue have been rated CARE A-Stable (pronounced as Single A Minus with Stable outlook) by CARE Ratings Limited (CARE Ratings).

Purpose of the Issue

The Company plans to allocate the net proceeds from the Issue—expected to be around Rs. 14,769.63 lakh, after covering Issue-related expenses payable by the Company—toward the following purposes (collectively called the “Objectives”):

- To support onward lending, financing, and to repay or prepay the principal and interest on existing borrowings of the Company.

- For general corporate purposes.

Keep reading and supporting thezipco!